Switching to the Satoshi standard and Lightning Network connectivity makes Bitcoin more tangible and easy to use. AAX has made the first move in the crypto space, already providing BTC to SAT

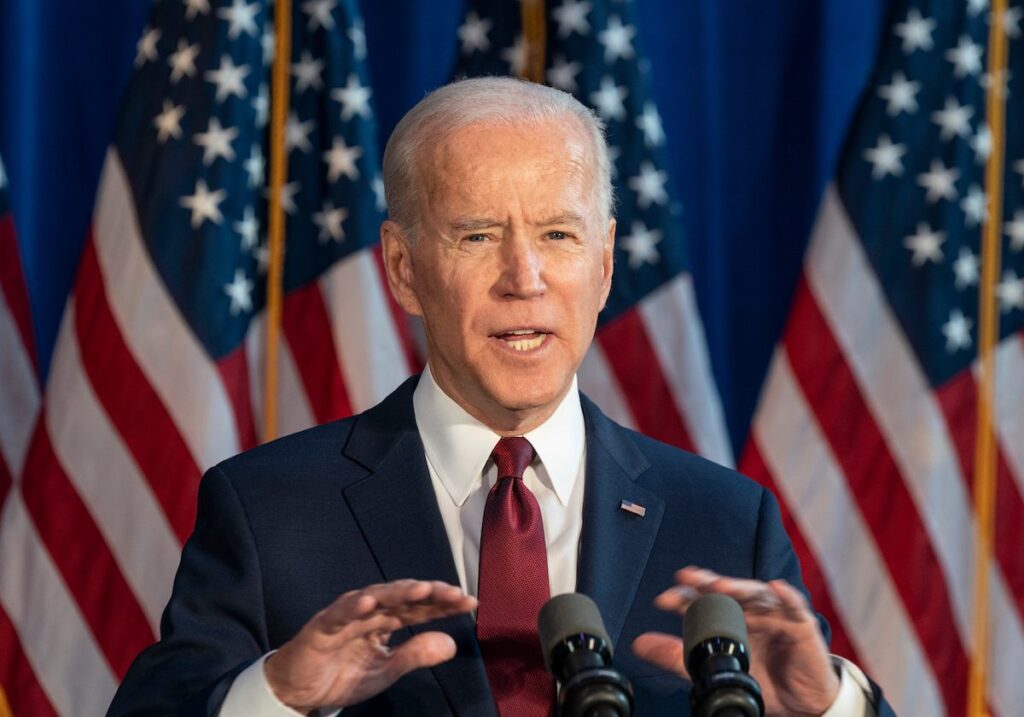

Biden signs order on cryptocurrency as its use explodes

LivePresident Joe Biden on Wednesday signed an executive order on government oversight of cryptocurrency that urges the Federal Reserve to explore whether the central bank should jump in and create its own digital currency.

The Biden administration views the explosive popularity of cryptocurrency as an opportunity to examine the risks and benefits of digital assets, said a senior administration official who previewed the order Tuesday on the condition of anonymity, terms set by the White House.

Under the executive order, Biden also has directed the Treasury Department and other federal agencies to study the impact of cryptocurrency on financial stability and national security.

Brian Deese and Jake Sullivan, Biden’s top economic and national security advisers, respectively, said the order establishes the first comprehensive federal digital assets strategy for the United States.

Binance Launches Payments Technology Company, Bifinity

LiveBinance, the world’s leading blockchain ecosystem and cryptocurrency infrastructure provider, has today announced the launch of Bifinity as its official fiat-to-crypto payments provider.

Powered by Binance, Bifinity is a payments technology company that connects businesses, merchants and millions of users to the world of crypto and blockchain. Merchants can use Bifinity’s intuitive APIs to get their business crypto-ready and start accepting crypto payments. At the same time, consumers will have access to more user-friendly buy-sell crypto services and entry points.

“As the crypto and the Web3 economy continue to grow, we see greater demand to build improved fiat-to-crypto on-ramps to bridge the gap between the traditional finance industry and the decentralized and centralized crypto economy. At Binance, the vision is to increase the freedom of money globally. With the launch of Bifinity, we aim to accelerate mass crypto adoption,” said Helen Hai, President of Bifinity

Bifinity supports:

- Over 50 cryptocurrencies globally

- All major payment methods, including VISA, Mastercard and more

- Buy to sell crypto service for consumers

- Simple, intuitive and seamless API integration for merchants

- Low cost payment process fees for merchants

- Top-tier KYC onboarding process

Bifinity will also partner with leading crypto wallet providers and blockchain platforms, including Safepal and Ziliqa, to offer fiat on and off ramp solutions for their user base.

Building Web 3.0 with Payment Leaders

Cryptocurrencies will eventually power the economy for Web 3.0, the internet’s latest iteration. As part of efforts to build the Web 3.0 economy, Bifinity is partnering with Paysafe, a leading specialized payments platform; and Checkout.com, a leading global payments processor, to expand crypto access globally and allow more users to buy and sell crypto.

“We expect global e-commerce to continue outpacing the growth of traditional commerce—especially with the adoption of cryptocurrencies and NFTs,” said Max Rothman, VP of Crypto at Checkout.com. “Our payment rails already power the world’s leading crypto exchanges, representing almost 80% of the global trading volume. And that’s why our foundational partnership with Bifinity and the Binance platform is so important. Together we are lowering the barrier to entry for merchants to accept and make their first cryptocurrency transactions, enabling them to seize the great web3 opportunity that lies ahead.”

Through these partnerships, Bifinity will upgrade its on-ramp payment processing infrastructure This includes future plans to integrate enhanced fraud detection and payment transacting. Additionally, Paysafe will provide Bifinity with a deep regulatory know-how of fiat-to-crypto payments and an embedded finance solution that acts as a white label digital wallet. The embedded finance solution has already strengthened Bifinity’s on and off ramp capabilities and reactivated their SEPA bank transfers and Faster Payments.

Philip McHugh, CEO of Paysafe, said: “We have been very impressed by Binance’s commitment to grow as an evolving and maturing business and have witnessed first-hand their incredibly strong and positive customer engagement as they focus on delivering a payments service that consumers want. We’re very proud to partner with them, and we’ve already got off to a strong start with the successful delivery of a white label Bifinity wallet solution and we’re now working on some further exciting opportunities together. For us, this partnership is a great example of how we help our customers overcome payments pain points and grow.”

Future Plans

Bifnity will work in tandem with Paysafe to expand into Latin America, where it has a market-leading real time payments service. In the UK and Europe, Bifinity will integrate Paysafe’s card processing service over the next couple of months. On the NFT front, Bifinity will soon launch NFT checkouts, which allow users to buy NFTs across different platforms by linking their DEX wallets.

Joe Biden To Sign Executive Order on Crypto This Week

LivePresident Joe Biden is reportedly preparing to sign an executive order on cryptocurrency policy this week, according to a report by Reuters on Monday, which cited a person familiar with the matter.

The order, which may seek to appoint an individual with regulatory authority to oversee the crypto market, could come as early as Wednesday, per the report.

Jurisdiction of digital asset market oversight continues to burn in the minds of regulators eager to close the gap on what they perceive as trading activity occurring outside their remit.

Last month, Commodity Futures Trading Commission (CFTC) chair Rostin Behnam told a Senate committee hearing his agency wanted to be charged with regulating the crypto spot market.

During that hearing, Benham was asked whether a lead agency for regulating crypto should be established and said that his agency, along with the Securities and Exchange Commission, should share the responsibility.

Capital Bank of Jordan takes live Blink neobank built with Codebase Technologies platform

LiveIn March 2021, Capital Bank of Jordan partnered with Codebase Technologies to build Blink, the first digital-only neobank in Jordan. The project officially commenced in late 2021 and in February 2022, Blink went live for Jordanian customers.

Blink was born out of a simple belief: money is meant to be easy; it’s meant to work for people, and not the other way around. Jordanians can open a Blink account directly from their smartphone with their Jordanian ID, in just 15 minutes, gaining access to an instantly issued virtual debit card and account. A physical card will be delivered directly to their chosen address. In addition, users can manage their accounts, send and receive money, view their transaction history and withdraw money from domestic and international ATMs.

Blink also offers its users instant credit cards which are issued within 3 minutes of an application and do not require a salary transfer by the customer. Blink neobank also offers its customers the highest credit card grace period in Jordan, allowing up to 60 days for settlement.

A robust product and service roadmap has been put in place that will offer Blink users new experiences and services as the neobank evolves and grows. The mobile-based neobank addresses the needs of the Jordanian market where mobile penetration stands over 90% of the total population as of 2020.

Built using Codebase Technologies’ award-winning DigibancTM platform, Blink incorporates an innovative UI system based almost exclusively on swiping – similar to how millennials and Gen Zers interact with social media – the first of its kind for a neobank. Together, Capital Bank of Jordan and Codebase Technologies developed Blink’s proposition, user journeys, launch strategy, and overall user experience. Blink’s enhanced agility and efficiency will foster the growth of Capital Bank of Jordan and counter security threats, high operation costs, and lack of transparency, which are key factors in digital banking from a customer and banks standpoint.

Codebase Technologies was able to configure its modular and highly flexible DigibancTM platform to allow Capital Bank of Jordan the flexibility and freedom to create a bank offering as per their exact requirements; one that is ready for new product and service innovations in the coming months and years. Using DigibancTM flexible and scalability nature Codebase Technologies was able to help Blink go live in just six months from project start.

Blink’s newly appointed CEO, Zein Malhas, points out “Blink will disrupt traditional banking by addressing the existing gaps from both banks and customers’ perspectives. We’re grateful to Codebase Technologies for being a committed partner and helping us in our journey of building a neobank. The chemistry between both teams was fantastic and we’re happy the team helped us bring our vision to life so quickly and to such a high standard. We look forward to further growth in the product and expansion to new markets in the future.”

Tamer Al Mauge, Managing Director – MENA of Codebase Technologies, added “The launch of Blink was a huge milestone for Codebase Technologies in Jordan and for the market. Building and launching the first neobank in Jordan is no small feat and we’re happy to have worked on this with Capital Bank of Jordan. The collaborative effort on this project was really inspiring and we look forward to continuing our work with Capital Bank of Jordan and their amazing team.”

SEBA Bank Secures Financial Services Permission from Abu Dhabi Global Market and Opens Office in Abu Dhabi

SEBA Bank, a fully integrated, FINMA licensed digital assets banking platform, today announced that it has secured a Financial Services Permission (FSP) from Abu Dhabi Global Market’s (“ADGM”) Financial Services Regulatory Authority (“FSRA”) effective as of 07 February 2022. Following receipt of this FSP, SEBA Bank has opened an office in Abu Dhabi ADGM to strengthen support for its regional partners in the provision of regulated digital asset services.

The FSP authorises SEBA Bank to conduct regulated activities in the ADGM, including advising on investments or credit, arranging credit and custody, and arranging deals in investments; pursuant to the Financial Services and Markets Regulations 2015 (“FSMR”).

The office opening in Abu Dhabi will further accelerate the considerable growth that SEBA Bank has achieved over the past year. In January, SEBA Bank closed a USD 120M Series C round enabling continued high-trajectory institutional business growth through further investment in product offering and technology. ADGM is part of SEBA Bank’s strategy to establish licenced presences in the markets which we serve. With the dedicated office in Abu Dhabi, the bank will further expand headcount across operations, sales, and business development in the region.

Guido Buehler, CEO at SEBA Bank, said, “We are proud to receive a licence from the ADGM FSRA to provide our digital asset banking services in the ADGM. This licence is a valuable addition to our existing licences, as a FINMA regulated banking and securities dealer and licensed provider of custody services for Swiss Collective Investment Schemes for Digital Assets. Backed by the UAE’s sovereign wealth fund, Mubadala Investment Company, Abu Dhabi’s international financial services centre, ADGM is a leading global hub for driving innovation in technology and business development and will offer valuable support in meeting our growth objectives for the region. Our new office in the thriving business and financial district on Al Maryah Island will serve as a strategic hub for SEBA Bank to cater effectively to the evolving needs of our customers in the UAE and across the region.”

Dhaher Bin Dhaher Al Muhairi, CEO of the Registration Authority at ADGM, said, “We welcome SEBA Bank to ADGM’s expanding family of financial institutions at an incredibly exciting juncture for the thriving digital asset landscape. ADGM constantly seeks to advance its financial services offering to enhance the vibrant ecosystem and contribute to the growth and diversification of the Abu Dhabi economy. We look forward to supporting the SEBA Bank in its global growth strategy and serving as the GCC hub for business, financial services and client servicing activities.”

SEBA Bank is the Swiss smart bank providing a secure, institutional-grade, universal suite of regulated banking services for the new digital economy. As one of the world’s first fully licensed banks with a core capability in digital assets, SEBA Bank is trusted by investors, financial institutions, and corporations to seamlessly guide clients into the digital asset economy. SEBA Bank is a leader in innovation in digital asset services and has launched a number of landmark products in response to client demand.

Christian Borel, Senior Executive Officer and Branch Manager at SEBA Bank AG ADGM, added, “The UAE is a global leader in digital assets and blockchain, with the Emirates Blockchain Strategy 2022 providing a clear plan for cementing its place as a global hub for blockchain innovation. Abu Dhabi has established clear regulatory frameworks which allow licensed companies to operate with clarity in the country. As a regulated bank, SEBA Bank can act as a trusted counterparty to those interested in digital asset investment and banking services in the region.”

ADGM-based FinaMaze announces the launch of the Metaverse Smartfolio

LiveFinaMaze Metaverse Smartfolio bundles stocks of the companies leading the way in the Metaverse. Among them are familiar tech names, video game publishers, software developers, entertainment industries and infrastructure and hardware manufacturers. The Metaverse Smartfolio includes for good measure a controlled exposure to a crypto exchange and to Ethereum, the cryptocurrency that serves as the basis for virtual reality blockchain platforms such as Decentralan and Sandbox, allowing users to purchase, build and monetize virtual reality applications.

Metaverse is deemed to become the future of the internet, the next frontier of technology, already fuelling the improvement of the hardware (smartphones, glasses, VR headsets), the development of faster cloud services, larger processing capacity and wider bandwidth.

“The Metaverse, the virtual world, is already a “reality”, says Mehdi Fichtali, CEO and Founder of FinaMaze.

Tech giant Microsoft’s Teams is embracing the movement with the development of Mesh. Video Game publishers Roblox, Electronic Arts, Unity Software are developing three-dimensional content. Graphic card and chip manufacturer Nvidia launched Omniverse, an open platform for virtual collaboration and real-time physically accurate simulation. But the ultimate recognition came from the rebranding of the tech heavy-weight Facebook’s into Meta Platforms along with a $10-billion investment to develop products supporting augmented and virtual reality.

“The Metaverse is born, and major companies, such as JP Morgan, Walmart, Verizon and Adidas, are setting foot on it, in a way or another. But the adoption will certainly not be a straight line or happening overnight. Nor will the stock market performance journey”, adds Mehdi.

FinaMaze Metaverse smartfolio diversifies across over a dozen securities, spreading the risk among different sectors and automatically rebalancing the allocation to remain in line with each investor’s unique risk profile.

FinaMaze launches the Metaverse smartfolio as not all investors have the time and the expertise to conduct exhaustive and exhausting research on each market theme and build a carefully chosen selection of securities to translate the exposure they desire.

“And they neither want to be glued to their smartphone, constantly checking on their portfolio. Attracted by our dedicated risk controls, several investors are actually migrating to FinaMaze, which automatically rebalances each portfolio to remain in line with each investor’s personal risk appetite. This was all the more welcomed as the year started with Nasdaq’s negative -12% year-to-date performance. In this context, only Metaverse-related securities that have already been “corrected” by the market have been added to the smartfolio, to ensure an entry point appreciably below recent all-time highs.”

One of the most innovative and protective feature is the “Metaverse vs Market” version that allows market-pessimistic but metaverse-optimistic investors to capture the relative performance of the Metaverse-related securities over the market: if Metaverse securities indeed fall but in proportions less than the market, the “Metaverse vs Market” performance will then deliver the favorable difference.

FinaMaze investors have access to over 30 ready-to-invest thematic smartfolios, built thanks to the heavy lifting of FinaMaze investment committee experts, with the help of the computational power of AI and automated algorithms. Investment starts from $2,000 and investors can access tools and charts to track their own smartfolios real-time performance, put Take Profit and Stop Loss at the level of each smartfolio and exit, for free, on a daily basis.

The launch of the FinaMaze Metaverse Smartfolio is set to coincide with the opening of Dubai’s Museum of the Future, resonating with the vision of UAE’s leadership and residents, who want to live the future today.

ConnectPay partners with Salt Edge to offer a smooth open banking payments experience

ConnectPay, one of the fastest-growing Electronic Money Institutions (EMI) in Lithuania, joined hands with Salt Edge, a leader in providing open banking solutions, to offer the best payments experience to its customers in Germany and the Netherlands.

Living in the continuously shifting world of fintech, modern customers are always seeking instant, secure, simple, and most importantly, fully-fledged solutions. The disruptive future of digital banking and the whole fintech industry bolster the transformation of niche EMIs into an all-in-one fintech engine with a broad range of services. ConnectPay, an ambitious member of the EU fintech scene, offers a one-stop shop solution for all payment facilities under one roof for internet-based companies while collaboration with Salt Edge complements the company’s strategic goal to implement open banking payments.

ConnectPay strives for the best user experience and has been looking for a partner that could help with integrating multiple APIs of banks across Germany and the Netherlands as the technical documentation differs depending on each bank and more resources are needed for analysis and development if all done in-house. Salt Edge Payment Initiation solution will allow ConnectPay to integrate with a list of all required financial institutions and offer merchant services based on open banking in Germany and the Netherlands, aiming to constantly widen the list of supported countries.

Collaborations and partnerships drive the fintech industry forward. Salt Edge lived up to our expectations and offered a one-size-fits-all solution to reach the most popular financial institutions in Germany and the Netherlands, rather than integrating them one by one. Combining the strengths of Salt Edge and ConnectPay will enable us to offer high-quality merchant services to our e-commerce customers.

Marius Galdikas, CEO at ConnectPay

We are excited to join hands with ConnectPay, a company dedicated to providing the most innovative solutions and seamless user experience to merchants through open banking technologies. Our solution provides ConnectPay access to major banks in Germany and the Netherlands with a single connection and enables them to offer high-quality merchant service to their customers.

Vasile Valcov, VP at Salt Edge

Plot Twist: Russia to Legalize Bitcoin

LiveAfter the 20th January 2022 announcement that the Russian Central Bank proposed a ban on mining and the use of cryptocurrencies, we see a swift change of wind in the attitude towards Bitcoin coming directly from the Kremlin.

According to the Russian government official statement, the turnover of crypto financial assets will be regulated by the state with strict obligations for all participants in the professional market and an emphasis on protecting the rights of ordinary investors.

The purpose of the regulation is to integrate the mechanism for the circulation of digital currencies into the financial system and ensure control over cash flows in the circuit of credit institutions.

In addition, it is planned to introduce an obligation for market participants to inform citizens about the increased risks associated with digital currencies.

The implementation of the concept will ensure the creation of the necessary regulatory framework, will bring the digital currency industry out of the shadows and create the possibility of legal business activities.

The Ministry of Finance, the Bank of Russia, Rosfinmonitoring, the Federal Security Service, the Ministry of Internal Affairs, the Federal Tax Service, the Ministry of Economic Development, the Prosecutor General’s Office took part in the discussion of the regulation of the cryptocurrency market.

The legislation will reportedly be drawn up no later than Feb 18.

Protocol Labs and Faber Join Forces to Launch Web3 Hackathon and Accelerator Program

Protocol Labs and Faber are collaborating to help foster the development of the next generation of the internet. The partnership combines Faber’s experience as early-stage deep tech VC and Protocol Labs’ Web3 expertise to help entrepreneurs create the building blocks of successful new companies in the decentralized web.

As open-source research, development, and deployment laboratory, Protocol Labs has created benchmark Web3 projects such as Filecoin and IPFS and collaborates with a curated community of partners such as Outlier Ventures (UK), Longhash Ventures (Asia), or Techstars (US).

Based out of Portugal – a fast-growing hub of Web3 talent – Faber will leverage its experience as an early backer of AI/data-driven founders to work with Protocol Labs in helping form, fund, and accelerate new companies working on blockchain technologies in Continental Europe – at the core of this partnership are a virtual hackathon and a remote accelerator program

The Faber Web3 Hackathon will run from mid-February to mid-March, including two days of talks and workshops to get all the teams up to speed with the most relevant and up-to-date technologies and frameworks needed to build a Web3 project. Faber and Protocol Labs will be looking for talented teams working on hard engineering such as cryptography, blockchain technologies, or distributed systems to build new protocols, tools, infrastructure services, or applications to drive Web3 use cases.

Applications for the hackathon will open on January 24th and Protocol Labs will sponsor at least €75,000 in awards to be distributed among the submitted projects, with more details on how to apply coming in the next few days.

Starting in mid-April, the Filecoin Faber Accelerator will run for three full months and a select batch of 10 teams will have access to a world-class program put together to maximize their chances of success. Faber and Protocol Labs will back and accelerate teams leveraging Filecoin and IPFS to build innovative blockchain companies in multiple business cases and across the Web3 technology stack.

The program aims to help pre-seed teams create and develop their businesses, with technical, financial, and operational support from Faber and Protocol Labs together with top experts in areas like DeFi, tokenomics, smart contracts, governance, NFTs, UI, etc. Each selected team will also receive at least €80,000 of pre-seed investment directly from Faber and Protocol Labs, while during the program they will have multiple chances to pitch to and get mentorship from some of the leading VCs in the Web3 space.

Alexandre Barbosa, Managing Partner at Faber, said, “A new generation of entrepreneurs is building a decentralized stack of new protocols, tools, and algorithms to address the hard challenges of efficiency, scalability, security, privacy or cross-chain operations, as well as in the distributed services and applications of Decentralized Finance (DeFi) or NFTs. Faber is proud to be partnering with Protocol Labs, who is already a driving force behind the Web3 movement, in backing these teams.”

Colin Evran, Ecosystem Lead at Protocol Labs, said that “Faber has been successfully backing AI/data-driven startups and impressive founders from Europe. We are delighted to partner with Faber to further ignite Europe’s community of entrepreneurs building the next generation of Web3-driven companies on IPFS & Filecoin. The number of high-quality applications building on Filecoin has increased by a factor of 8x in 2021, reaching millions of users and accelerating the transition from Web2 to Web3. With the help of Faber’s programming, mentorship, and network, we’ll help even more developers and entrepreneurs successfully build businesses on Web3 tech.”

More details on how to apply to the remote Filecoin Faber Accelerator will be announced in the coming weeks.

Doconomy and Salt Edge: Merging impact tech and open banking for a sustainable future

Doconomy, a Swedish world-leading impact tech provider for banks, SMEs, and corporates, joined forces with Salt Edge, a leader in offering open banking solutions, to use data aggregation and transaction categorisation services to speed up introduction of climate functionality to the European market.

As concerns about climate change have grown over the past years, the importance of the emerging fintechs that offer various convenient ways for consumers to reduce their carbon footprint, has increased too. Being the trailblazer in this movement, Doconomy aims to inspire shifts in behavior and mitigate the impact of everyday transactions, leading the fight against unsustainable consumption and environmental destruction.

Doconomy provides digital tools which allow customers to become environmentally-conscious by assessing, per transaction, the CO2 emission and H2O consumption impact based on the world-leading Åland Index. Collaboration with Salt Edge allows Doconomy to facilitate the introduction of applied impact solutions for banks and corporates in Europe. By leveraging Salt Edge’s account information and transaction categorisation tools, Doconomy can introduce climate impact calculations functionality within a short time to market, without major investment in legacy systems.

Doconomy is committed to driving innovation for a sustainable future. The new era of shared responsibility between consumers and financial services invites everyone to join. Partnering with like-minded companies, we aim to accelerate the transition to greener financial services. Salt Edge services help us speed up the introduction of applied impact solutions for banks and corporates in Europe. We believe that such collaborations can have a positive impact in shaping a more resilient tomorrow and guide consumers towards more sustainable choices in their everyday consumption.

Doconomy co-founder and CEO Mathias Wikström

Salt Edge is excited to partner with Doconomy – a world-leading provider of applied impact solutions which empower consumers to take convenient but tangible steps toward carbon neutrality. When it comes to the climate emergency, open banking becomes an important gear wheel in the mechanism that helps to accelerate positive climate efforts and enables consumers to calculate and offset their impact of everyday transactions. Doconomy’s Åland Index-powered Carbon Calculator together with Salt Edge’s open banking services bridge the gap between awareness and action when it comes to boosting positive climate efforts and responsible consumption.

Dmitrii Barbasura, CEO at Salt Edge