Switching to the Satoshi standard and Lightning Network connectivity makes Bitcoin more tangible and easy to use. AAX has made the first move in the crypto space, already providing BTC to SAT

Cryptocurrency comes to the Masses – Thanks to TikTok’s Influencer

LiveCryptoWendyO, as she’s known to hundreds of thousands of viewers on TikTok, YouTube and other platforms, proceeds with her latest dispatch on the ground-shifting world of digital currency. CryptoWendyO is among a new class of influencers narrating the wild turns of global markets, redefining how younger audiences get their financial news and analysis.

DU Telecom and Dubai Airport Free Zone Partner to Implement Blockchain-Enabled Platform

LiveEmirates Integrated Telecommunications Company, operators of DU have partnered with Dubai Airport Free Zone Authority (DAFZA) to automate licensing processes for activities that require a no-objection certificate from other government agencies in a single platform enabled through blockchain.

First Bitcoin Fund in UAE listed on Nasdaq Dubai

LiveThe Bitcoin Fund managed by 3iQ, a Canadian digital asset investment fund manager with more than C$2.5 billion in assets under management has been listed on Nasdaq Dubai, the region’s international exchange. The Fund was approved to be listed in April this year, and it offers investors an indirect exposure to Bitcoin by trading its units within a world-class regulated and transparent exchange environment as well as the opportunity for long-term capital appreciation through a convenient alternative to a direct investment in the crypto currency.

Finsight Recap: This week in Crypto, Blockchain & Fintech

LiveMajor Trump Fundraiser Suggests Use of Blockchain Technology for Voting

This week saw former US President Donald Trump taking a swipe at cryptocurrency, bitcoin calling it a “scam” that takes “the edge off of the dollar.” However, in a sharp rebuttal, the millionaire former chief executive of U.S. online retailer Overstock, Patrick Byrne has said that the country’s voting system should rely on blockchain or paper ballots only and further went on to call bitcoin the future of money.

Partnership for Digitisation of Football through Blockchain

Football federation UEFA has announced a five-year global partnership with blockchain business AntChain to jointly explore how blockchain technology can be used to further the digital transformation of the football industry and improve the experiences of fans around the world. AntChain will also become the official global blockchain partner of UEFA EURO 2020.

Global Content Creators Embrace latest Blockchain Technology for Industry

The world’s first content marketplace that aims to build a collaborative content ecosystem with the core purpose of seed funding, incubating, and curating filmmakers, YouTubers and content producers around the World will be launched this June. $MCONTENT is expected to revolutionize the global content landscape using the power of blockchain.

Cryptocurrency Ethereum Launched into Space

Blockchain network agency SpaceChain has successfully sent a blockchain-enabled payload into space aboard a SpaceX Falcon 9 rocket launched from NASA‘s Kennedy Space Center. With the first demonstration of the Ethereum cryptocurrency technology integration when the payload is installed at its destination, SpaceChain will allow customers to use the payload for enterprise business transactions and fintech applications once tested and activated.

Over $50 million in losses from crypto scams to US Investors in the first quarter of 2021

Consumers in the US reported $52.6 million in losses from crypto scams to the Federal Trade Commission (FTC) in the first quarter of this year. The report also showed that scams related to cryptocurrencies or other digital assets in the US were also heavily targeted toward younger people.

America’s Largest-Known Cryptocurrency Real Estate Deal Closed in Miami

Miami Beach’s Most Expensive Penthouse Just Sold in America’s Largest-Known Cryptocurrency Real Estate Deal. The 9th floor Lower Penthouse at Arte by Antonio Citterio was bought – all cash paid for entirely in cryptocurrency, making it the most expensive known residential crypto real estate transaction in the U.S. to date.

Filipino Fintech Receives a Digital License

UNObank has become the first Filipino fintech to receive a license outright to operate a digital bank. This is after Singapore headquartered fintech DigibankASIA Pte. Ltd., one of the primary incorporators of UNObank, received approval from the Bangko Sentral ng Pilipinas (BSP) to operate a digital bank in the Philippines which will be entirely regulated under the Digital Banking License framework in the Philippines.

eCommerce Biometrics Launched in UAE

Abu Dhabi Islamic Bank in collaboration with Visa have launched the first biometric authentication solution for online transactions in the United Arab Emirates. The new security solution will tap into Visa’s Consumer Authentication Service to level up user experience and data security.

Hong Kong Invests more into Local Fintech Ecosystem

A new Fintech Cross-Agency Co-ordination Group is to be established by the Hong Kong Monetary Authority (HKMA) to formulate supportive policies for the local fintech ecosystem. The formation of the group is one of a range of initiatives adopted by the central bank as part of its Fintech 2025 strategy plan.

Tiger Global Invests Into Construction Industry Fintech Platform

Tiger Global Management has led a $30Million Series B funding into Briq, a fintech for the construction industry. The financing is among the largest Series B fundraisers by a construction software startup, and brings Briq’s total raised to $43 million since its January 2018 inception.

Why El Salvador Bets Big On Bitcoin

El Salvador will become the first nation in the world to formally adopt the digital coin as a currency.

How can El Salvador benefit from bitcoin? What are the potential risks? And how on the other hand will the move change what does that mean for bitcoin?

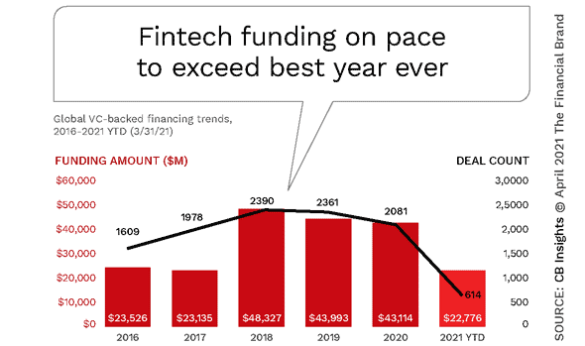

Global Fintech Funding Records New High Quarter1 of 2021

LiveSource Fintech Weekly: The quarterly “State of Fintech Q1’21 Report”, published by CB Insights provides a recap of global funding trends, sector-by-sector analysis, as well as a recap of major happenings in the fintech space during the quarter. This report also serves as a guide to what segments of banking are being prioritized by the marketplace.

In the first quarter of 2021, fintech firms worldwide raised $22.8 billion in investments through 614 deals. – more than doubling the amount raised in the fourth quarter of 2020 – and representing the largest venture capital-backed fintech funding quarter ever, according to research released by CB Insights. The first quarter 2021 numbers even surpassed the the previous funding record from Q2’18 that included Ant Group’s $14 billion funding round.

Much of the growth in the first quarter can be attributed to the 57 mega-rounds of $100 million+ that occurred in the first quarter. This was the most mega-rounds ever, accounting for 69% of total funding in the quarter. This made the average deal size for Q1’21 almost double what was seen in Q4’20 – from $19.3 million to $37 million.

North America led the fintech funding race (264 deals/$12.8B), followed by Europe (151 deals/$5B) and Asia (147 deals/$3.7B). Combined, these three regions accounted for over 90% of the total fintech funding for the quarter. While Australia (11 deals/$193M) and South America (20 deals/$999M) both saw modest increases in deals, Africa saw a 22% drop in deals during Q1’21 (21deals/$45M). Europe saw funding growth almost triple quarter-over-quarter, attributed to mega-rounds which accounted for 68% of the continent’s total funding for the quarter.

Not All Sectors Participated Evenly in Fintech Funding Growth

When the funding is broken down by sectors, there were some that saw significant growth in Q1’21, while others saw only modest gains. The largest levels of funding were in the payments, digital banking, digital lending and wealth management sectors