Switching to the Satoshi standard and Lightning Network connectivity makes Bitcoin more tangible and easy to use. AAX has made the first move in the crypto space, already providing BTC to SAT

Coordinated central bank action to enhance the provision of US dollar liquidity

- ECB and other major central banks to offer 7-day US dollar operations on a daily basis

- New frequency effective as of 20 March 2023 to remain in place at least through the end of April to support smooth functioning of US dollar funding markets

The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve and the Swiss National Bank are today announcing a coordinated action to enhance the provision of liquidity via the standing US dollar liquidity swap line arrangements.

To improve the swap lines’ effectiveness in providing US dollar funding, the central banks currently offering US dollar operations have agreed to increase the frequency of 7-day maturity operations from weekly to daily. These daily operations will commence on Monday, 20 March 2023, and will continue at least through the end of April.

The network of swap lines among these central banks is a set of available standing facilities and serves as an important liquidity backstop to ease strains in global funding markets, thereby helping to mitigate the effects of such strains on the supply of credit to households and businesses.

Paymentology powers Fondeadora to launch Apple Pay in Mexico

LivePaymentology, the leading global issuer-processor, and Mexico’s leading financial service provider Fondeadora, today announce a strategic partnership to expand payment services in Mexico and are among the first to bring Apple Pay to digital banking customers in Mexico.

Fondeadora is a digital financial services provider in Mexico that aims to address the shortcomings of the conventional banking system. Through its advanced app, both individual and corporate clients can use, save, and manage their money more efficiently. As part of a new collaboration, Fondeadora is leveraging Paymentology’s cutting-edge cloud-based digital payment platform to deliver a seamless payment experience to its customers. By doing so, Fondeadora can offer faster transaction processing, advanced security measures, and enhanced data analytics.

This marks a significant achievement for the partnership as Fondeadora has become one of the front-runners in Mexico to offer its customers the convenience of using their debit card through their Apple Wallet. With this feature, cardholders can quickly and securely make payments online or in-store with participating merchants who accept this payment method.

Jorge Fernández General Manager at Fondeadora commented: “We’re incredibly proud to be one of the first financial institutions in Mexico to bring Apple Pay to our customers. Without the help of our steadfast issuer-processor partner, Paymentology, we wouldn’t have been able to launch such a dynamic service. We look forward to our continued relationship with the expert team at Paymentology and creating many more industry milestones.”

Fondeadora’s launch of Apple Pay is a significant step forward in providing the latest and most innovative financial services to Mexico’s payments market which has a projected Compound Annual Growth Rate of 15.75% (2022-2027). It enables customers to make payments across several Latin American countries: Argentina, Colombia, Costa Rica, Brazil, and Peru as well as anywhere else in the world that accepts Apple Pay.

Dark March: Signature Bank Closed by Regulators Citing Systemic Risk

LiveDark March continues for the US-based banks, with three consecutive banks shut down by regulators in the past days, despite Yellen’s assurance that SVB’s collapse is not a contagion. State regulators closed New York-based Signature Bank (SBNY.O) on Sunday, two days after authorities shuttered Silicon Valley Bank (SIVB.O) in a collapse that stranded billions in deposits.

The Federal Deposit Insurance Corporation (FDIC) took control of Signature, which had $110.36 billion in assets and $88.59 in deposits at the end of last year, according to New York state’s Department of Financial Services.

All of the depositors of Signature Bank and Silicon Valley Bank will be made whole, and “no losses will be borne by the taxpayer,” the U.S. Treasury Department and other bank regulators said in a joint statement.

Representatives for the lender did not immediately respond to a request for comment.

Signature’s failure followed Silicon Valley Bank’s Friday shutdown, the second largest in U.S. history behind Washington Mutual, which collapsed during the 2008 financial crisis.

Investors were unnerved by the speed at which startup-focused SVB, the 16th largest lender in the U.S., was toppled by customer withdrawals. The episode last week erased more than $100 billion in market value from U.S. banks, prompting swift action from government officials over the weekend to try and restore confidence in the financial system.

Silicon Valley Bank scrambles to reassure clients after 60% stock wipe-out

LiveAccording to Reuters, SVB’s CEO Gregory Becker has been calling clients to assure them their money with the bank is safe, according to two people familiar with the matter.

SVB Financial Group (SIVB.O) scrambled on Thursday to reassure its venture capital clients their money was safe after a capital raise led to its stock collapsing 60% and contributed to wiping out over $80 billion in value from bank shares.

SVB, which does business as Silicon Valley Bank, launched a $1.75 billion share sale on Wednesday to shore up its balance sheet. It said in an investor prospectus it needed the proceeds to plug a $1.8 billion hole caused by the sale of a $21 billion loss-making bond portfolio consisting mostly of U.S. Treasuries. The portfolio was yielding it an average 1.79% return, far below the current 10-year Treasury yield of around 3.9%.

Investors in SVB’s stock fretted over whether the capital raise would be sufficient given the deteriorating fortunes of many technology startups that the bank serves. The company’s stock collapsed to its lowest level since 2016, and after the market closed shares slid another 26% in extended trade.

Some startups have been advising their founders to pull out their money from SVB as a precautionary measure, the sources added. One of them is Peter Thiel’s Founders Fund, according to one of the sources.

One San Francisco-based startup told Reuters they successfully wired all their funds out of SVB on Thursday afternoon, and the funds had appeared in their other bank account as a “pending” incoming wire by 4 pm Pacific Time on Thursday.

Bybit partners with Mastercard to offer crypto payments debit card

LiveBybit announced the launch of Bybit Card, a debit card powered by the Mastercard network, issued by Moorwand. This card will allow users to off-ramp crypto into the fiat world to make purchases or take out cash from ATMs with ease.

Bybit Card will enable users to skip intermediaries and other off-ramp providers and debit their crypto balances directly to pay for goods and services. It will be available for clients in eligible countries in Europe and the UK who have completed the necessary KYC and AML procedures.

Initially, Bybit Card will be available for a selection of blue-chip cryptocurrencies, namely, BTC, ETH, USDT, USDC, and XRP. Payment requests will automatically convert balances in these digital assets into EUR or GBP, depending on the client’s country of residence.

Bybit launched its free virtual card earlier this week allowing for online purchases, with a physical card planned to launch in April. The plastic cards will be mailed directly to clients and allow them access to ATM withdrawals as well as spending at merchants worldwide with spending limits aggregated across currencies held in their Bybit account.

“Bybit users will be able to access and manage their funds faster, more securely, and more conveniently,” said Ben Zhou, co-founder and CEO of Bybit. “By launching Bybit Card, we are creating a full 360-degree journey for our users, offering next level reliability, products, and opportunities. We are confident that these innovative payment solutions will improve people’s lives and are a step towards a brighter future for crypto and finance.”

Christian Rau, Senior Vice President, Fintech and Crypto, Mastercard Europe added “Mastercard enables customers, merchants and businesses to move digital value — traditional or crypto — however they want, with the confidence that they are doing so safely and securely. With launches like this, we’re excited to continue to innovate in payments by making digital assets more accessible across the ecosystem.”

Crypto Exchange MaskEX Launches Virtual Card and Appoints Ben Caselin as Vice President

LiveMaskEX, a rapidly expanding third-generation crypto exchange, headquartered in Dubai, has announced the launch of its crypto-backed Virtual Card, enabling users to spend their crypto as fiat in more than 176 countries with over 50 million merchants worldwide. This new feature is now available to all ID-verified MaskEX users.

MaskEX has also announced that Ben Caselin, former Head of Research and Strategy at Hong Kong-based crypto exchange AAX, has joined MaskEX in the role of Vice President. Drawing on nearly 4 years at AAX, Mr. Caselin has played an important role in driving the mainstream adoption of bitcoin and digital assets through the platform, especially in emerging markets. At MaskEX, Mr. Caselin will oversee all global and localized marketing, communications and business development initiatives.

“We are excited to offer our users the ability to spend their crypto wherever and whenever they want with the launch of the MaskEX Virtual Card,” said Eric Yang, CEO of MaskEX. “Our vision is to make crypto more accessible and find ways to integrate crypto more with people’s everyday lives.”

“We are also delighted to be joined by Ben Caselin, not only because we believe he can play a vital role in our global expansion efforts, but also because of the terrible situation he has witnessed up close at AAX, following the collapse of FTX in late 2022. As we have observed, he puts users before business, and in reaching out to Ben, we have specifically asked him to be uncompromising and closely scrutinize our operations.”

“As a third-generation crypto exchange we are one of only 18 centralized exchanges globally that provide Proof-of-Reserves,” said Mr. Yang, “and with Abu Dhabi’s Sovereign Wealth Fund, under Sheikh Hamad Rakadh Salem Hamad Alameri, as a major stakeholder, we know we are in a very good place to compete with the world’s biggest trading platforms.”

On joining MaskEX, Mr. Caselin stated that “while the industry is still suffering from contagion and a severe lack of investor confidence, we cannot afford to give up now.”

“At this stage in the development of this nascent industry, properly managed centralized exchanges can still play an important role in raising awareness around digital assets, providing a point of contact for regulators, cooperating with the existing banking sector and payment providers to accelerate integration, and, of course, in driving the mainstream uptake of bitcoin and digital assets everywhere.”

FinaMaze Appoints Industry Leader Grant Niven as New Board Advisor

FinaMaze has announced the appointment of Grant Niven to its Advisory Board, effective February 2023.

The ADGM-based innovative digital wealth management firm made the announcement in pursuant to progress in its growth and sustainability, as it continues to provide cutting-edge financial investment services within the Fintech space.

Originally from Scotland, UK, Grant has worked in several executive roles over the last 24 years spanning the technology, consulting and financial services industry, in both Europe and the Middle East. Prior to recently founding Mingzulu, a strategy & venture funding advisory, focused on the Financial Sector, (including Fintechs), Grant held a role as Head of Group Digital at Banque Saudi Fransi, (BSF), HQ in Riyadh, KSA; where he was accountable for defining and executing the Bank-wide digital vision and strategic initiatives across the organisation.

Among other significant roles, he previously held a partner position within EY Middle East & North Africa (MENA) where he led the Technology Advisory practice for the financial services sector across the region.

Grant is a regular public speaker and prominent voice at leading events across the region on the topics of digital banking and ventures, Fintech, Open Finance and adoption of disruptive technologies in the financial services sector.

With his rich experience, he is clearly a great addition and good fit for the FinaMaze Advisory Board; as the firm has carved a niche for itself since 2020 as an innovative digital wealth management establishment working to push beyond the limits of what has traditionally been known to be ‘possible’ in Personalised Asset Management.

Speaking on his latest role at FinaMaze, Grant said: “Delighted to support the next chapter of growth for FinaMaze leadership, shareholders and end customers. Mehdi Fichtali (CEO) and the wider board’s vision and ambition to transform wealth management has really caught my attention and impressed myself and fellow Mingzulu team with what has been achieved to date. We are really looking forward to supporting the next chapter of innovation in the Wealth & Asset Management sector and honored to work in partnership with Mehdi and his team to accelerate their strategy & growth plans. The industry is ripe for disruption and FinaMaze has the smarts, people with deep wealth advisory expertise, combined with leading technologies such as Artificial Intelligence (AI) to make not only a huge regional impact – but internationally on a global stage ”.

Mehdi Fichtali is the CEO of FinaMaze, and this is what he has to say about Grant’s appointment to the Advisory Board:

“We are absolutely thrilled to welcome Grant to our Advisory Board! With his extensive experience spanning over two decades at the forefront of the intersection between technology and banking, Grant brings an unparalleled wealth of knowledge to our team. As an ex-partner at one of the top four consulting firms and a former Head of Digital at a major Saudi banking group, Grant is not only a strategic thinker but also an execution guru in the digital banking space. We are confident that his expertise will prove invaluable in guiding us through the ever-evolving landscape of the financial industry, particularly in the Wealth and Asset Management space for banks in the region. We can’t wait to see the amazing things we’ll achieve together with Grant on board!”

In his market projection for 2023 made during the last episode of “Light in the Markets Maze” – a webinar hosted by FinaMaze; Mehdi mentioned it likely being an eventful year for investing looking at the emerging trends that favour personalised asset management rather than an overall passive investment.

FinaMaze has over the years introduced and actively managed both long and short personalised Smartfolios that have offered various protection options.

It is expected that the firm will make a number of key appointments in line with its vision, and these would be announced within the course of the year. To know more about FinaMaze, download the app or kindly contact +971 58 538 8757 or email [email protected] with your enquiries.

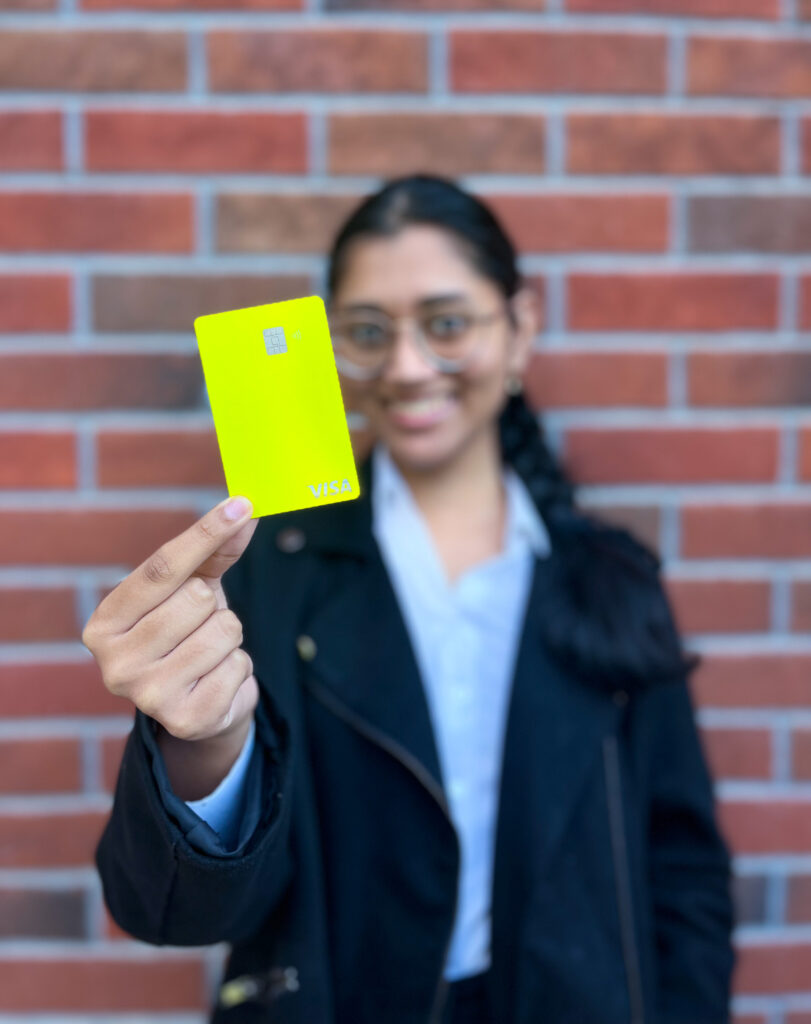

Savii Goes Live in UAE and Announces Launch of Numberless Visa Cards for Youth

LiveSavii, the financial platform designed for teens and young adults, today announced their official product launch in the UAE. The Savii payments app and Visa prepaid card allows teenagers and young adults to make payments independently and relieve parents of the anxiety of giving them premature access to their own credit card.

Jane Harvey, Co-founder and CEO of Savii commented “If you are a parent, giving your teens some financial responsibility early on is a smart move. They’ll get to flex their money management skills, like budgeting and saving, learn the value of a dirham and begin to appreciate the consequences of overspending. And yes, they may make small mistakes along the way, but that’s all part of the journey, right? By the time they’re adults, they’ll be more confident with their finances which will boost their overall confidence and independence.”

With the newly launched Savii app, parents can now send money to their teens instantly through the app making the distribution of monthly allowances a lot easier. As an important bonus, Savii allows parents to view all the transactions made by their children giving them further peace of mind. The app is accompanied by the Savii card, a numberless Visa payment instrument which means all card details are stored securely in the Savii app. The numberless card feature eliminates the risk of personal card information getting disclosed if the card gets lost or stolen, and the card can be paused or blocked at the click of a button in the app.

Nichola Collinson, Co-founder of Savii added “We have designed a product with the worries and concerns of the parents in mind, and we managed to bring to the market a product that will bring financial independence to the teenagers while parents can be at peace that the systems in place are designed to protect the identity and financial security of their kids. We partnered with the best in the market at Visa to create a truly secure card.”

Alex McCrea, Visa’s Vice President, Head of Strategic Partnerships and Ventures for Central Europe, Middle East and Africa, added “At Visa, we understand the importance of empowering the next generation with the tools they need to independently manage their finances. Our partnership with Savii will provide young adults in the UAE with the freedom and flexibility to make purchases, build their credit history, and take control of their financial future. We are delighted to partner with Savii as part of our pledge to enabling financial inclusion for everyone, everywhere, and are confident that this partnership will make a positive impact on the lives of young people in the region.“

Savii’s product roll-out in the UAE is the first of a series of regional launches set to be announced in the coming months.

Hong Kongbased livi bank moves into wealth management

ivi bank, Hong Kong’s leading lifestyle-driven virtual bank, is continuing its development with the pilot launch of its wealth management service, which follows closely on livi’s launch of its first offering to Hong Kong’s SME business community.

livi is now able to distribute funds managed by third-party fund managers to its customers as part of its wealth management offering as a registered institution, following approval for registration to carry out Type 1 Regulated Activity (Dealing in Securities) under the Securities and Futures Ordinance. livi will begin its pilot launch of this service shortly, with its full public launch targeted later in the first half of the year.

With a vision of helping customers seamlessly manage their wealth, livi bank is committed to leveraging its technological expertise to provide a simple, convenient and secure digital platform for accessing wealth management solutions.

David Sun, livi bank Chief Executive Officer, said “We are excited to further expand our financial footprint with innovative offerings with many industry firsts already introduced, including livi PayLater, our NFT collections, and our market-first fully-automated business account opening.

“Our wealth management solutions will address the underserved needs in the market with simple and transparent digital solutions for customers to grow their wealth. Wealth management will be an important business driver for livi and we will continue expanding our digital wealth capabilities to empower our customers to achieve their financial goals,” David Sun added.

Paymentology appoints Nadia Benaissa as global head of marketing

LivePaymentology announces the appointment of Nadia Benaissa as Global Head of Marketing, and member of its leadership team.

Nadia is a seasoned marketing expert with a passion for fintech, bringing with her more than 20 years’ experience across five continents, in payments, banking and fintech. As the global Head of Marketing at Paymentology, Nadia will spearhead the company’s continued expansion across the UK, Europe, Middle East and Africa, Asia-Pacific and Latin America.

Abe Smith, Chief Growth Officer at Paymentology commented on the appointment: “With two decades of experience in leading cross-functional global marketing teams in the fintech industry, we are incredibly excited to welcome a leader of Nadia’s calibre to the team. Her proven track record of delivering results through strategic marketing communications, and passion for the industry, make her the perfect candidate to support us in achieving our growth ambitions.”

Nadia Benaissa, Global Head of Marketing at Paymentology added: “Throughout my career I have chosen to work with dynamic fintech organisations that are leading from the front in the global progress towards the digitisation of financial services. That’s why I am delighted to join the Paymentology team. With customer centricity at the core, together with its clients and partners, Paymentology is providing access to financial services and placing cards into the hands of millions of people across the globe, via localised, data-driven, next generation payment solutions. I look forward to building on the existing successes of the organisation with an enhanced global marketing programme.”

An active member of the fintech ecosystem, Nadia co-chairs the payments committee at the MENA Fintech Association, is a member of the financial inclusion working group at Payments Association UK, and an active member of the Financial Alliance for Women. Nadia is also a mentor to burgeoning fintechs and startups at Startupbootcamp, the world’s largest network of multi-corporate backed accelerators.

Prior to joining Paymentology, Nadia was the Marketing Director at BPC, supporting its growth journey, along with the creation of new fintechs and before that worked at Germany’s Digital Fintech and neobank Fidor as the Global Chief Marketing Officer developing its international growth. She has also worked with CR2, an Irish-headquartered omnichannel banking player, leading the company’s communications and marketing strategy across emerging markets.

At the start of her career, Nadia was the youngest employee at AEMS Paris, a joint venture between Euronext and Atos, where she helped set up the corporate communications and marketing department from the ground up. The company developed ‘exchange as a service’, with trading, clearing and settlement solutions dedicated to stock exchanges worldwide and was further acquired by the New York Stock Exchange (NYSE Technologies).