Kenya’s fintech ecosystem registered an unprecedented boom using accessible tech to mobilize consumers in ways never seen before aiding the financial inclusion mission. Here are the top 10 fintech companies driving innovation in Kenya.

1. Abacus

Abacus goes ahead to offer a better life to Kenyans by advising them to save and invest in places that give the best returns for their money.

Abacus fights for the rights of all Kenyans and wishes them to grow; therefore, they have quite several products and services they offer to Kenyans to help them grow and explore: stocks, bills and bonds, unit Trusts, pension funds, foreign currency, and cryptocurrency. Abacus can deliver all those services incorporations with Kenya’s largest financial institutions.

2. BitPesa

The eight-year-old digital foreign exchange and payment platform was the first blockchain company licensed by the UK’s financial conduct authority. BitPesa leverages blockchain settlement to significantly lower the cost and increase business payments speed to and from frontier markets.

The credit-based service provider, Branch international, uses digitized technology to provide financial services to people without bothering them and traveling long distances.

As their mission says, “to deliver world-class financial services to the mobile generation” indeed, branch international can offer you a loan anywhere so long as you have an account with them. Currently, branch international serves over 3,000,000 customers; they have had over 15 million loans given and over $350 million disbursed.

4. CarePay

CarePay developed a system to support people’s health that can operate with a mobile phone; you can save, receive and send the money however it should specifically be for healthcare. Health care providers, patients/people, insurers are both connected under one system; thus, access to each other is fast and effective.

CarePay is a fully Kenyan established fintech with branches in Nigeria and Tanzania. CarePay employs over 250 people and is privately owned by Micheal Slootweg, who founded it in 2015.

Chura allows Kenyans to have access to financial services, for example; airtime, mobile money from anywhere across the country. Chura limited was founded by Bryon Sitawa in 2013, a Nairobi university graduate, to be a solution rather than a problem.

6. Eastpesa

With Eastpesa, you can instantly send money and receive money; they don’t have to delay you. It’s more interesting with scheduled payments because it’s an automatic sure deal; oh yes, it is and only with EastPesa.

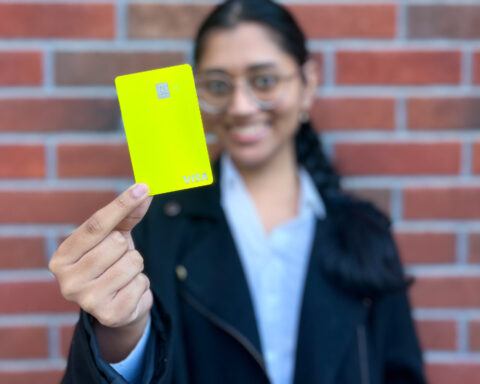

Eastpesa operates from Kenya, Uganda, and Tanzania through Mpesa, Airtel Money, Tigo money, and Mtn mobile money. Eastpesa allows the use of cards as well, such as Visa, Paypal, and MasterCard. More clarity on services offered by Eastpesa; they do instant cash payouts, scheduled payments, save your contacts and buy airtime.

7. FarmDrive

FarmDrive is a privately owned entity with over 50 employees founded in 2014 by Peris Bosire and Rita Kimani. FarmDrive supports rural smallholder farmers to access loans to help them buy what they need to expand their agricultural produce, for example, fertilizers and improved seeds.

The fact that many smallholder farmers are excluded, FarmDrive came up with a solution for them in 2014. It generates real-time credit reports for farmers to access loans from banks and fintech and agricultural input providers through mobile money.

8. JamboPay

Jambopay allows its subscribers to send and receive money through their mobile phones by using the internet. You can pay your bills, shop goods, make purchases, pay school fees, offertories and donations using JamboPay.

The vision of JamboPay is “the heart and soul of e-payments and related financial services globally.” On top of allowing online payments through; Mpesa, airtel money, T-CASH, bank payments, visa, and MasterCard debit and credit cards. JamboPay also supports local social corporate responsibility through the JamboPay foundation in Kenya.

9. PesaPal

PesaPal allows payments using cards like Visa and MasterCard. Online payments by PesaPal can be made in three ways: In-store payments, Online Payments, and PesaPal mobile app; this gives a variety to users to choose what is convenient to them. You can use PesaPal to pay for your electricity bills, prepaid tokens, and TV subscription bills, buy airtime, event tickets, as well as food delivery orders, and above all those transactions, are done at a zero cost.

Pezesha Africa Limited supports small and medium-sized enterprise owners to have access to capital financing for their businesses.

Pezesha was established in Kenya in 2016. Since then, it has enabled small and medium-sized businesses to access working capital from banks and other financial lending institutions through a collaborative approach.

Pezesha offers small and medium-sized businesses access to people (investors), unified data, and capital. Pezesha has offices in Ghana and Nigeria.